Let me tell you about one of my favorite apps: Rally.

Rally is a platform that allows investors to buy and sell equity shares in collectible assets.

Collectable assets include everything from rare baseball cards to the 100 foot Barosaurus skeleton that they IPO’d last week (and sold out 200,000 shares in just a few minutes).

Here’s how it works:

Rally sources, verifies, and acquires the most noteworthy items from around the world.

They turn those items into “a company” via regulatory qualification, then split it into equity shares.

There’s an “Initial Offering” on Rally where investors of all sizes can purchase shares.

Investors can buy and sell those shares in the app.

My updated portfolio: stocks, bonds, and dinosaurs.

This is not investment advice. For all disclosures, visit rallyrd.com/disclaimer.

Here’s the full story how we raised our Series A in less than a week.

After a tumultuous first year that included the tragic passing of our CTO, we ended up getting the business off the ground with a decent amount of momentum.

I would regularly receive inbound from lots of the top VC firms to take meetings and “build the relationship.” Admittedly, I find those to be a huge waste of time and almost always ignore them.

I have a pretty outspoken thesis on this: if you prioritize your time to be heads down actually building the business instead of taking meetings, those same VC’s will still take your call when you need them. Let the numbers do the talking.

One day I received an email about a “LA founders dinner” that caught my eye. Working alone in your room for 16 hours a day has its pros and cons. When I saw that specific email, I was probably craving just the slightest bit of social stimulus, so I replied that I was interested.

I didn’t realize until after that the invite was from Faraz at Lightspeed, who had been emailing and DMing me for months (see above: almost always ignore those). As part of the invite to dinner, he asked to meet prior and chat about beehiiv.

On the call he mentioned that he had some great guests attending the dinner, later revealing that Jessica Alba would be there. I told him that I’d come only if he sat me next to her, which he agreed to 🙃.

He asked if I would join an hour early to meet with his partner Nicole and chat more in-depth about beehiiv. In what should have been a 10 minute drive, took 45 minutes due to traffic (this is why I work remote). I arrived just a few minutes before dinner kicked off, and had Nicole and Faraz quickly rush through their investment thesis.

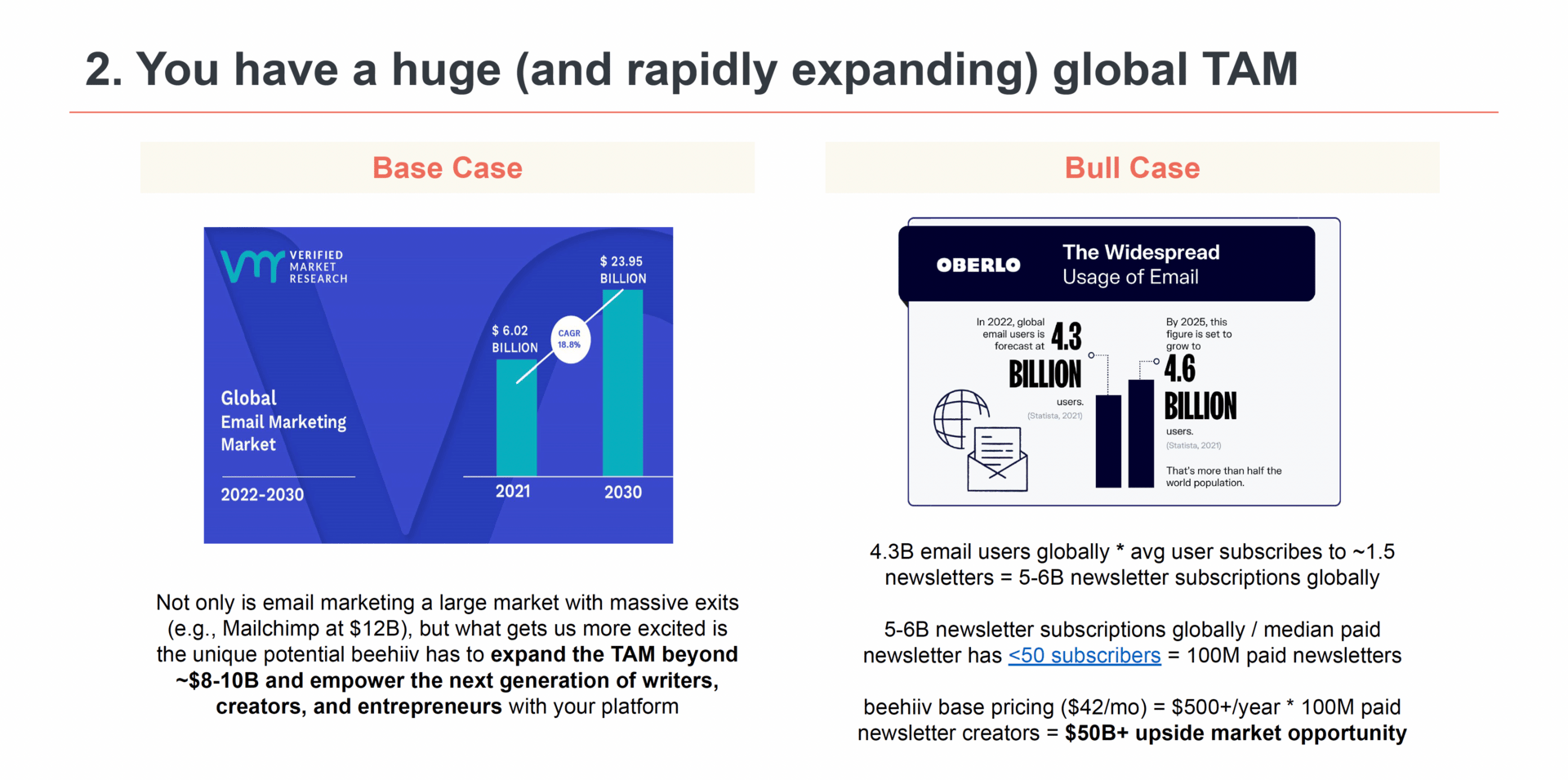

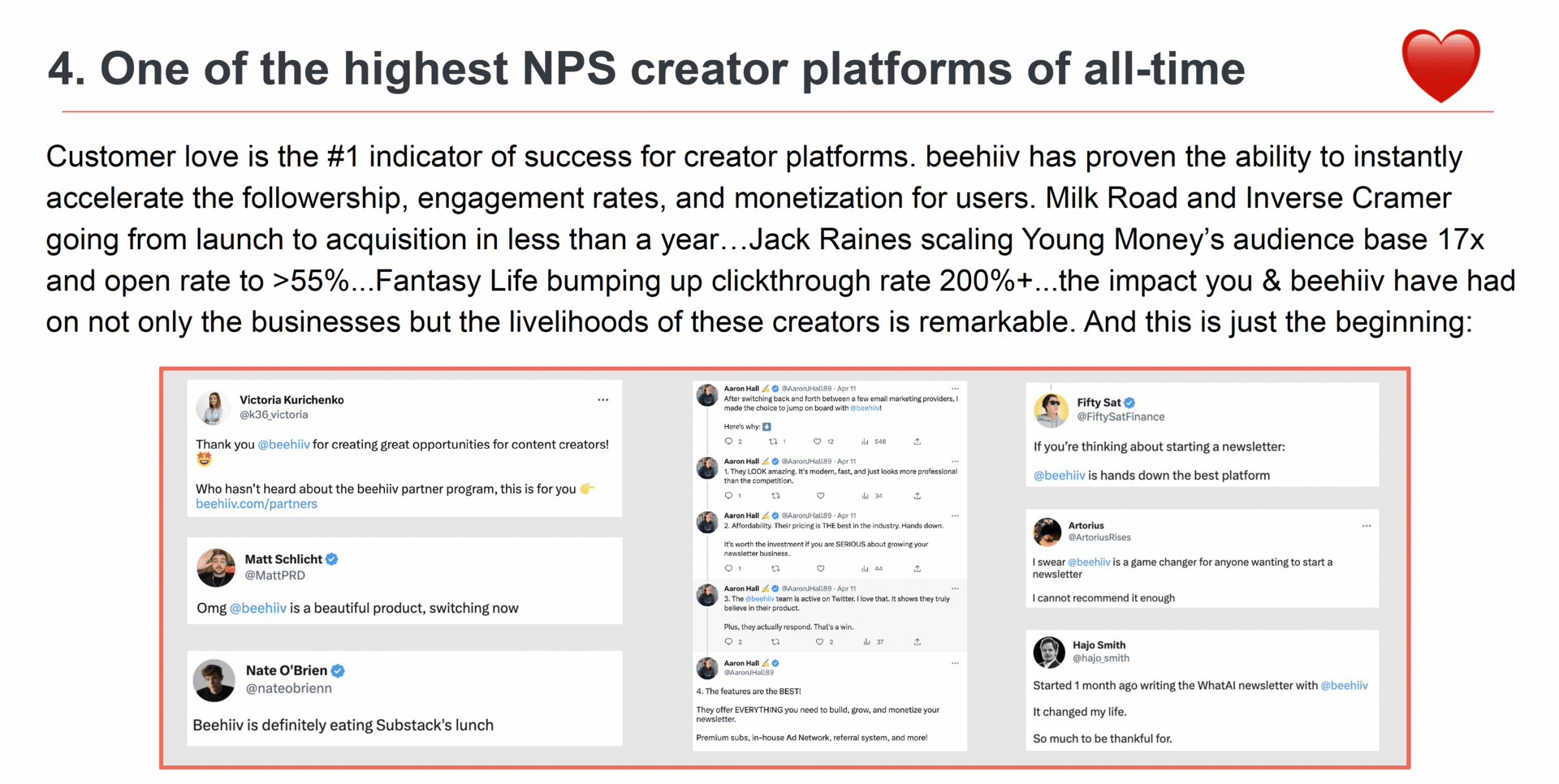

An investment thesis (or pitch book) is a deck put together by investors to build the case internally for why the firm should invest. They typically do a lot of proprietary research, speak to users and competitors, and size the market with a bunch of their own models. Ultimately, they often share the deck with the company as a way of providing value and showcasing their understanding and optimism for the business.

This was the first one I ever received for beehiiv. It was definitely flattering to have outsiders see and believe in my vision, but I still wasn’t interested in raising additional capital. I tucked it away and proceeded to dinner.

This was supposed to be confidential so don’t tell LSVP

Ditto

The dinner was solid and consisted of a good group of founders. Most importantly, I made Jessica laugh a few times (nbd).

Life went on and I went right back to building. The company was really beginning to hit stride; we surpassed $2M ARR, were growing revenue 30% MoM, and starting to scale the team a bit.

Then we had one of our biggest road bumps to date. It’s deep email infrastructure stuff so I’ll spare all the details, but it resulted in some of our most notable users having their emails land in spam. Which for an email platform, is probably the worst possible thing that could happen.

This is what led to ConvertKit’s founder spamming all of our users about the mishap, encouraging them to leave the platform, and then writing stupid blog post about the top 13 newsletter platforms and notably leaving us off the list except for a small footnote at the bottom about beehiiv having email deliverability issues. That’s when I made it my life mission to bury that company… but that’s beside the point.

Where were we? Right, we fucked up and made a small mistake that felt catastrophic in the moment, but in reality wasn’t fatal.

But for the first time, I felt vulnerable as founder. We had been on this rocket ship growing super quickly and I got my first taste of something going terribly wrong.

We had roughly $1M in the bank and were nearly breakeven each month after spending about $300K. While that in theory was fine, it left just about no room for error. Ultimately, my job as the CEO is to ensure the company can remain alive and live to see another day. The recent mishap sobered me up enough to realize we were probably flying a bit too close to the sun.

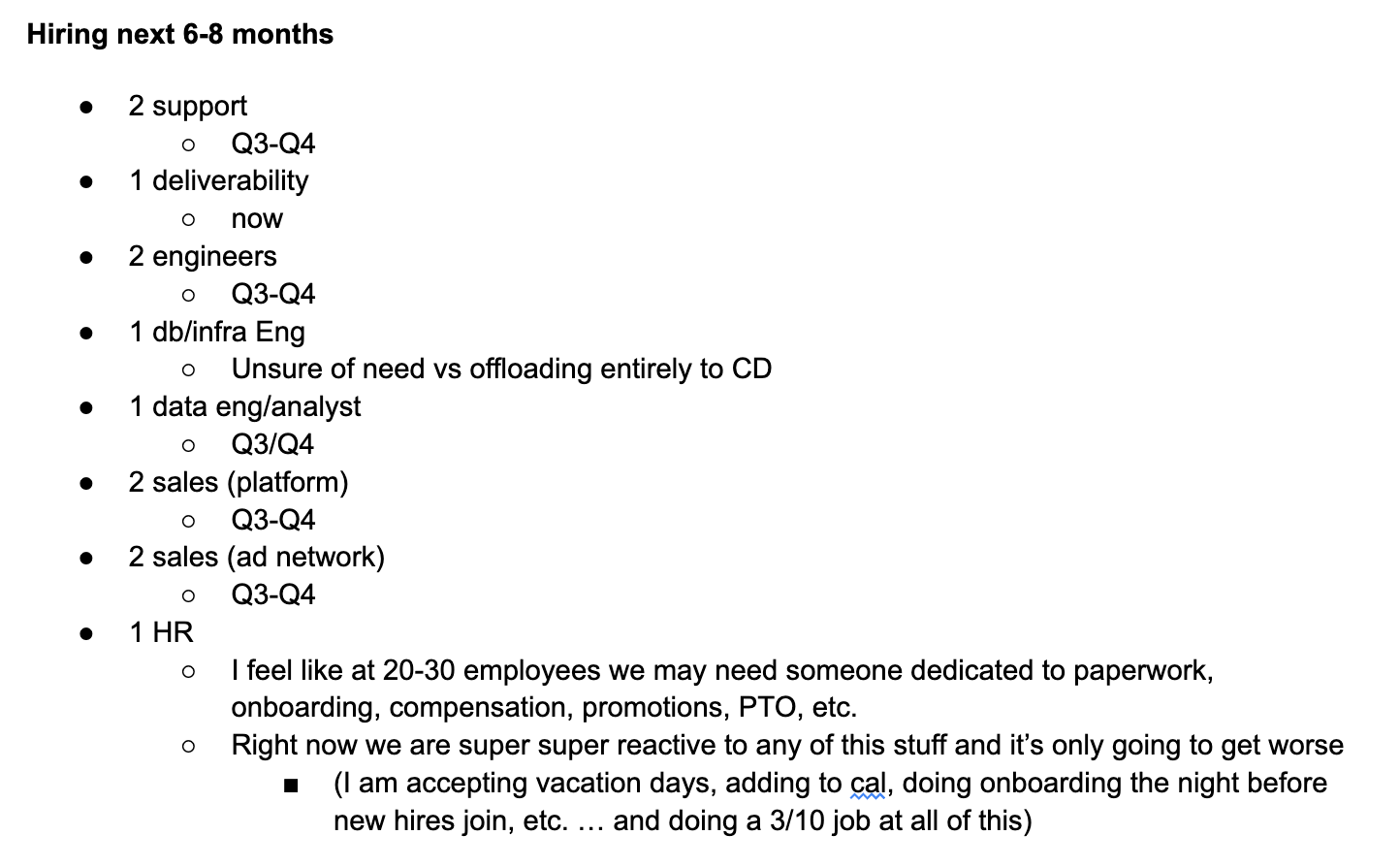

I had this whole realization on a Friday afternoon, and stayed up late writing a doc trying to answer the hypothetical “what would we do if we had $10M in the bank tomorrow?”

It was a pretty lengthy doc inclusive of the product roadmap, future hires, our growth strategy, and potential acquisitions. It was in this doc where I first suggested acquiring Swapstack, which we did a few months later.

Throw back to me running HR at the company

I slept on it and woke up Saturday morning concluding that raising a Series A was without a doubt the right decision. I fired off emails to a handful of investors who had been aggressively reaching out over the prior months… which went on to kick off one of the most chaotic weeks of my life.

I told those investors that we were looking to move quickly and I would prefer to jump right into calls with the decision makers. They obliged and I had 3 partner calls lined up on Monday with 3 different funds. We made our rounds, followed up with data requests, and had two term sheets in our inbox by Friday.

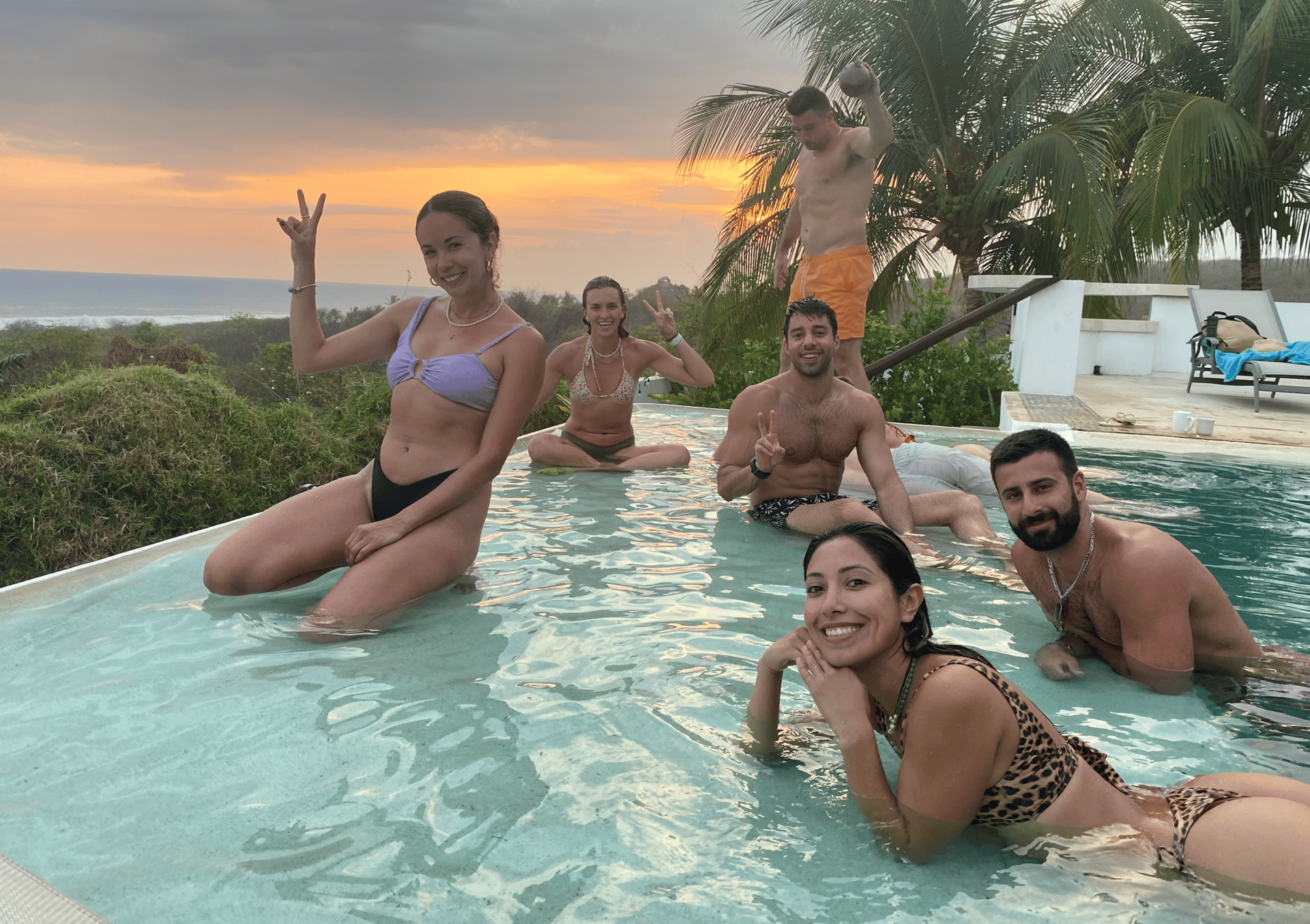

But prior to those term sheets hitting our inbox, we had about a dozen final diligence calls lined up on that Friday. It just so happened that I had a flight to Mexico City that day, where I planned to spend the week working remotely prior to celebrating Memorial Day Weekend in Puerto Escondido with all of my best friends.

Here we had two funds simultaneously pushing hard to get a deal done with us, and I was juggling calls, group chats, diligence, back channels, legal docs, reference checks, and countless email threads. I’ll never forget the chaos of dealing with all of that while phoning in from baggage claim in the Mexico City airport, then proceeding to jump from call to call in the back of a cab while traversing rush hour traffic.

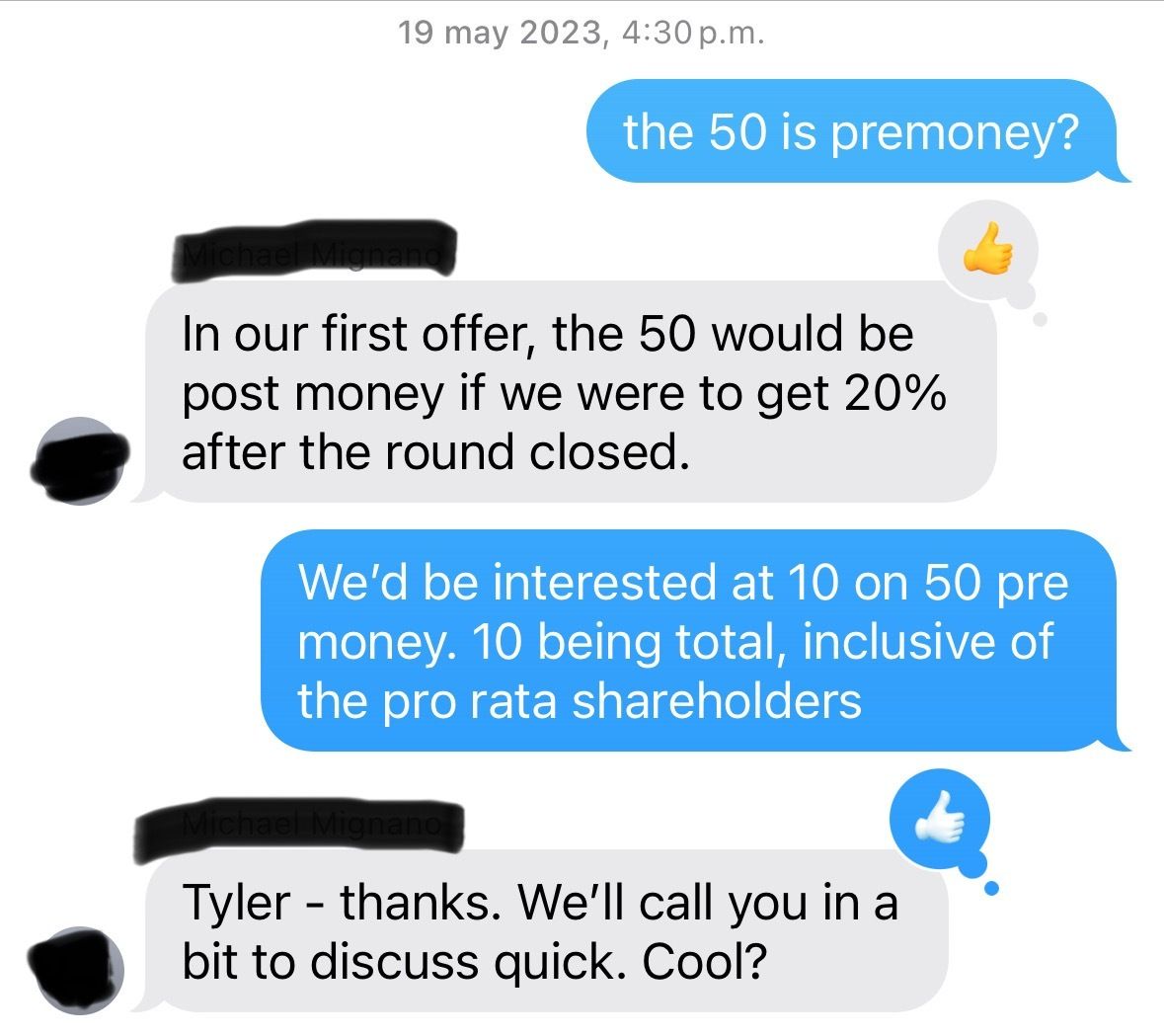

The first terms that we received were $10M on $50M post-money valuation. I thought that valuation was way too low, so I fired over a text that that wasn’t going to work. In the matter of minutes, I received a text back that had bumped the valuation up to $60M (a 20% increase over a single text!!).

It was at that moment I realized that none of these made up valuations ever really meant a thing anyway, it was all about the fund receiving a desired ownership percentage of the company. If the mandate was to own 10% of the company, whether it was $5M on $50M or $8M on $80M, it really didn’t matter (to an extent).

All of this was unfolding in the back of a Mexican cab. I eventually make it to my Airbnb where I’m finally able to open my laptop and unwind a few things.

I actually had a date lined up that night, which was honestly a much needed change of pace after the week I had. Even better given the language barrier, where my terribly broken Spanish wouldn’t allow me to talk about my week even if I had tried.

In those days, my Spanish was only good enough to buy me about 30 minutes of conversion, so we ended up spontaneously going to a Rauw Alejandro concert (pro tip: much easier to dance than to speak).

My friends were meeting me a bit later in the week, so I was alone for a couple of days. I woke up Saturday on a mission to get this deal across the finish line.

I tossed in my AirPods and walked over to this beautiful park, Bosque de Chapultepec. There I spent hours wandering and ruminating, intermixed with a few dozen calls between my cofounders, early investors, and lawyers.

That park has a special place in my heart. It was just such an interesting juxtaposition; here I am a white jewish guy from Baltimore, alone in Mexico City, negotiating over millions of dollars from this park bench. It all felt so surreal.

After a few hours of dotting I’s and crossing T’s, we had a final term sheet signed with Lightspeed to raise $12.5M at a $65M post-money valuation.

Just 7 days prior, raising a Series A wasn’t even on my radar. Just a little over a year prior, more than 40 investors passed on the opportunity to participate in our seed round.

From Jessica Alba to Mexico City, it was all just an outrageous series of events that led us to raising our Series A in less than a week, without even making a deck.

The rest of the week in the city was electric as always, as was celebrating the holiday weekend in Puerto Escondido with the homies.

If you enjoyed this post or know someone who may find it useful, please share it with them and encourage them to subscribe: mail.bigdeskenergy.com/p/series-a-story

Credit: Me

Could you imagine locking in from here? Tokyo nights, man.

Think you can generate a better office? Reply with your submissions 📨.

Turn on, tune in, drop out. Click on any of the tracks below to get in a groove — each selected from the full Big Desk Energy playlist.

Some of my favorite content I found on the internet this week…

20VC hosts Sequoia’s David Cahn to chat about the winners and losers in AI.

I love to nerd out on physics. This interview with Nobel Prize in physics winner, John Martinis, on the state of quantum computing was fantastic.

I also love a great ad campaign. Shoutout Tim Apple 👇

Share this newsletter with your friends, or use it as a pickup line.

👉 Your current referral count: {{ rp_num_referrals }} 👈

Or share your personal link with others: {{rp_refer_url_no_params}}

📥 Want to advertise in Big Desk Energy? Learn More